You’re seeing tech upcycling gain momentum because smarter sorting, AI, and modular robotics make recoverable materials more valuable and cheaper to reclaim. Clearer rules like EPR and eco‑design shift costs to producers and boost collection. New business models, digital product passports, and sensor‑driven logistics open revenue streams and consumer trust. Automation and reskilling cut hazards and raise yields while lowering emissions. Keep going and you’ll find how these pieces fit together and what that means.

Key Takeaways

- Strong regulatory pressure (EPR and recyclability standards) forces producers to fund collection, repair, and recycling, making upcycling economically viable.

- Investors and consumers favor circular products, driving corporate strategies toward refurbishment, modular design, and product-as-a-service models.

- Advanced sorting and AI-enabled processing raise recovery rates and purity, lowering costs and improving material value for upcycled tech.

- Digital product passports and traceability simplify refurbishing, secure data destruction, and compliant resale across markets.

- Upcycling reduces resource extraction and emissions while creating local jobs and new revenue streams from recovered materials.

The Rise of Automated Sorting and AI in E-Waste Processing

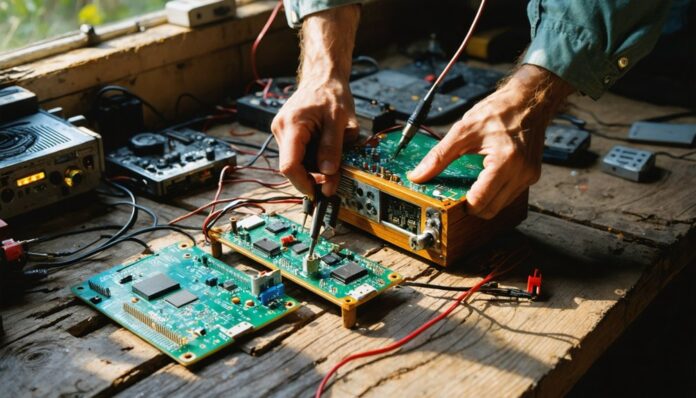

As e-waste volumes surge and regulations tighten, automated sorting powered by AI is becoming the backbone of modern recycling facilities. You’ll see AI sorting accelerate throughput and accuracy, letting communities meet stricter recovery targets together.

Sensor fusion—combining near-infrared, X-ray, and visible-light data—helps systems distinguish dozens of materials in real time, cutting contamination and improving purity. You’ll appreciate that machine learning boosts recovery rates for valuable metals and reduces manual handling, while modular robotics adapt as waste streams change.

Cloud monitoring and IoT links keep facilities aligned across regions, so operators and partners share performance insights. As someone invested in sustainable progress, you’ll find belonging in a network moving toward scalable, tightly regulated, and smarter e-waste processing. Recent forecasts project the global e-waste management market to reach USD 27.53 billion by 2032, underscoring the sector’s rapid growth and investment potential. Localized processing is also rising to meet demand and reduce emissions, driven by urban mining and regional recycling initiatives. This shift is further supported by rising levels of automation technology that enable higher-volume device processing and efficient material recovery.

Economic Opportunities From Upcycling and Value Recovery

When businesses and communities treat waste as feedstock instead of refuse, they open up diverse revenue streams—from high-value materials recovered in e-waste and solar panels to fashion yarn spun from ocean plastics and food products made from upcycled byproducts—fueling a circular market projected to grow from USD 656 billion in 2024 to over USD 2.6 trillion by 2035. You can tap construction returns from recycled concrete, extract value from end-of-life PVs, or join textile and beauty brands using upcycled inputs. Local entrepreneurship and rural revitalization benefit as community-based collection, processing hubs, and reverse-logistics networks create jobs and new SMEs. Increased investment interest is driving advancements in recycling technologies, especially in plastics mechanical and chemical recycling. Extended Producer Responsibility is also accelerating design and recycling investments. Many of these systems are enabled by IoT-enabled collection and AI-driven sorting that increase recovery rates and lower costs.

Regulatory Drivers: EPR and Design-for-Recyclability

Turning waste into value depends not only on market innovation but on rules that force producers to own end-of-life impacts. You’ll see EPR compliance pushing brands to fund collection and recycling, shifting costs from taxpayers to producers and binding brand owners to responsibility. States are accelerating laws and timelines, and PROs will coordinate system-wide collection so you’re not operating alone. Design-for-recyclability becomes a practical mandate: eco-modulated fees reward easily processed materials, and recyclability standards guide product choices from the start. You’ll face patchwork rules, SKU-level reporting, and infrastructure gaps across jurisdictions, but that reality also creates shared incentives to redesign products and share best practices. Together, you’ll adapt systems that make upcycling and circular design achievable. Governments and markets increasingly use eco-modulation to incentivize recyclable and repairable product designs. New programs in several states are already requiring manufacturers to register and report packaging data, creating state-level accountability. Seven U.S. states have already passed EPR laws, signaling rapid policy adoption.

Environmental Benefits of Keeping Materials at High Value

Because keeping materials at high value stops the need for constant extraction and reprocessing, upcycling sharply lowers the environmental cost of electronics and other tech products.

You join a community that protects finite resources by prioritizing resource preservation over virgin mining, keeping rare earths and polymers circulating.

That choice cuts energy use across the supply chain and supports emission reduction targets—upcycling can drop greenhouse gases dramatically versus incineration and avoids emissions tied to new material processing.

You help prevent toxic pollution from informal disposal, limit landfill growth, and reduce demand-driven extraction in concentrated supplier regions.

Upcycling also contributes to broader sustainability efforts by encouraging repair, reuse, and maintenance, thereby reducing overall consumption and saving money for individuals while saving resources.

Innovations in Material Purity and Separation Technologies

Although often unseen, recent advances in purity and separation tech are giving you the tools to recover materials far more accurately than before.

You’re part of a community using spectral sorting and laser separation alongside NIR, X‑ray, and induction sensors to tease apart plastics, glass, and metals by signature, density, and conductivity.

AI-powered vision and machine learning make real-time decisions that lift purity and reduce errors, while robotic arms and automated pickers scale precision without losing care.

Magnetic, eddy‑current, and gravimetric systems reclaim ferrous and non‑ferrous metals with new finesse.

Together these tools let you trust recovered streams for high‑value reuse, connecting your effort to a shared mission of smarter, more inclusive tech upcycling.

Digitization, Traceability, and Digital Product Passports

When you scan a product’s digital passport, you get a tamper‑resistant, searchable identity that follows a device from design to disposal. You’ll see verified product provenance, material composition, sourcing origins, and environmental impacts stored on NFC, QR, or RFID links tied to a blockchain ledger.

That lifecycle transparency supports repair, reuse, and accurate recycling decisions, so you and your community can trust recovery paths. Regulations like the EU’s Ecodesign and upcoming mandates push this data into standard practice by 2027, making compliance checks and customs verifications automatic.

As a member of a circular-minded network, you’ll use the passport to access repair histories, recycling instructions, and custody records, strengthening shared responsibility and enabling new services around upcycling and material recovery.

Corporate Strategies and Consumer Demand for Upcycled Tech

As investors, regulators, and younger shoppers push for greener choices, companies are retooling strategies to turn old devices into new revenue and reputation wins. You’ll see corporate incentives align with ESG goals, from modular design investments to product-as-a-service models that prioritize repair and reuse.

As consumer behavior shifts—especially among Gen Z and millennials—brands adapt supply chains, marketing, and transparency about material flows to build trust and belonging. Partnerships with certified refurbishers and ITAD providers let you buy back devices, guarantee secure data destruction, and recapture value while meeting extended producer responsibility rules.

When your community demands circular options, companies that upcycle responsibly not only cut waste but strengthen loyalty, attract talent, and unlock new, resilient revenue streams.

Scaling Infrastructure: IoT, Real-Time Monitoring, and Workforce Impacts

Because cities and companies are burying sensors into every bin, truck, and sorting line, scaling up IoT and real-time monitoring is becoming the backbone of efficient, accountable upcycling.

You’ll see IoT scalability everywhere as billions of devices, exploding market investment, and sensor-driven routes cut costs and emissions while tracking e-waste from curb to processor.

Real-time feeds let communities optimize collections, boost AI sorting accuracy, and recover higher-value materials together.

As automation reshapes roles, you’ll be invited into workforce reskilling programs that move people from hazardous manual tasks to technician, data governance, and robotics positions.

That shift keeps teams whole and skilled, building inclusive careers while systems improve yield, reduce waste, and make upcycling a shared, measurable success.

References

- https://esmartrecycling.com/blog/predictions-for-technology-recycling-in-2025

- https://www.startus-insights.com/innovators-guide/recycling-technology-trends-innovation/

- https://www.recyclingproductnews.com/article/42790/five-recycling-trends-to-watch-for-in-2025

- https://esmartrecycling.com/blog/technology-recycling-innovation-2025

- https://sadoffelectronicsrecycling.com/blog/e-recycling-trends-in-2025-what-businesses-need-to-know-phc/

- https://cordis.europa.eu/programme/id/HORIZON_HORIZON-CL4-2025-05-TWIN-TRANSITION-35-two-stage/it

- https://www.globenewswire.com/news-release/2025/07/03/3109692/0/en/Upcycled-Materials-in-Packaging-Market-Ramps-Up-in-2025-with-ESG-Goals-and-Regulatory-Support.html

- https://www.greyparrot.ai/waste-and-recycling-statistics-2025

- https://www.datainsightsmarket.com/reports/e-waste-sorting-machine-48406

- https://www.congruencemarketinsights.com/report/e-waste-management-market